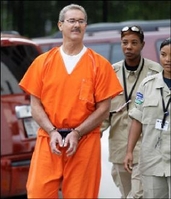

Billionaire R. Allen Stanford is escorted into the federal courthouse Thursday, June 25, in Houston. His lawyers filed an appeal Monday against the denial of bail. - FILE

A lawsuit seeking class-action status for hundreds of Latin American investors claims that a London-based insurance broker gave false assurances about the soundness of investments offered by financier R. Allen Stanford, now jailed on charges of operating a US$7 billion offshore pyramid scheme.

The lawsuit claims that Willis Group Holdings Ltd - the company for whom Chicago's Sears Tower was recently renamed - and its United States subsidiary provided letters from 2005 to 2008 that gave investors a misplaced sense of security regarding certificates of deposit offered by Stanford's bank in the Caribbean island of Antigua.

The letters claimed that insurer Lloyd's of London provided guarantees for Stanford's operations and that its finances had been independently audited. In reality, according to the lawsuit, there was no insurance for the CDs and the auditor was a small Antiguan firm controlled by Stanford.

"Willis provided these letters to Stanford, and sometimes directly to investors, knowing the statements were false, or with severe recklessness as to the letters' veracity," said the lawsuit filed by Venezuelan citizen Reinaldo Ranni, who is represented by Miami attorney Luis Delgado.

A Willis spokesman said the company would not comment on the lawsuit, filed last Friday in federal court in Miami.

Unspecified damages

The suit seeks unspecified damages on behalf of potentially 2,100 Stanford investors, with Ranni himself claiming some US$2.5 million in losses.

Stanford and three executives of his now defunct Houston-based Stanford Financial Group are accused by federal prosecutors of orchestrating a far-reaching pyramid scheme by misusing most of the US$7 billion they advised clients to invest in certificates of deposit from Stanford International Bank in Antigua.

Stanford faces up to 250 years in prison and his assets have been frozen.

A large chunk of those investments from hundreds of Latin Americans flowed through Stanford's opulent office in a downtown Miami high-rise.

Ranni's lawsuit contends that the assurances given by the Willis letters were a major reason investors felt comfortable with CDs that offered rates well above market averages.

The Willis letters said in part that Stanford was run by "first-class business people" and Lloyd's of London had provided insurance coverage for the bank for up to 12 years.

The letter also cited a "stringent" audit from an outside firm. The lawsuit doesn't indicate whether Lloyd's of London had provided any insurance of any kind.

"We have found that all our dealings with the bank have been conducted in a professional and satisfactory manner," the Willis letter says, according to the lawsuit.

"In reality, there was nothing safe, first class or satisfactory, let alone insured, about (Stanford's) products," the lawsuit says.

The lawsuit asks a judge to certify the lawsuit as a class-action representing all investors who relied on the Willis letters to make investments with Stanford. More than 2,100 accounts were opened in the Miami office, according to the lawsuit.

A similar lawsuit was filed on July 2 in federal court in Dallas by as many as 3,000 Mexican investors who claim they relied on assurances in Willis letters to invest in Stanford CDs.

That lawsuit claims damages could exceed US$1 billion.

Sanford's lawyers also argued an appeal Monday for his release on bond, saying he was not a flight risk.

Dick DeGuerin, Stanford's defense attorney, said that not only did his client have deep and long-standing ties to the Houston community, but he was also penniless.

"He had no access to funds to flee," DeGuerin wrote in the appeal.

Stanford was considered one of the richest men in the US with an estimated net worth of more than US$2 billion.

But DeGuerin said his client is now penniless and the question of the missing funds is not relevant to whether he should be freed on bond because prosecutors have not proven Stanford has access to that money.

However, investigators say Stanford secretly diverted more than US$1.6 billion in investor funds as personal loans to himself and they believe he could have access to vast wealth hidden around the world.

Stanford and executives Laura Pendergest-Holt, Gilberto Lopez and Mark Kuhrt pleaded not guilty last month to various charges, including wire and mail fraud, in a 21-count indictment issued June 18. The three Stanford executives are free on bond.

James M. Davis, ex-chief financial officer for Stanford's business empire, was charged with three counts in a criminal information also issued June 18. Davis, who has been cooperating with prosecutors and is free on bond, is set to plead guilty to the charges as part of a deal with the Justice Department during a court hearing on August 6.

Also indicted is Leroy King, the former chief executive officer of Antigua's Financial Services Regulatory Commission. King, accused of taking bribes from Stanford to overlook irregularities at his bank, is awaiting extradition to the United States.

The US Securities and Exchange Commission filed a lawsuit in February accusing Stanford and his top executives of committing crimes similar to those in the indictment.

- AP reports