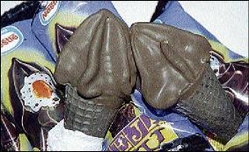

Nestle's Deja Vu Ice cream. - File

Shares in British chocolate maker Cadbury PLC hit their highest level in at least five years Monday on reports that another rival, Switzerland's Nestlé SA, may make a takeover bid.

Cadbury is already the target of a US$16.5-billion hostile bid from Kraft Foods which it has dismissed as "derisory".

US chocolate makers The Hershey Company and Italy's Ferrero International SA last week said they are also considering a possible offer for Cadbury, setting the stage for a potential bidding war.

Reviewing options

A report on Monday by Bloomberg cited two unidentified sources saying Nestlé is likewise reviewing its options about a possible offer.

Both Cadbury and Nestlé declined to comment.

Shares in Cadbury jumped two per cent to £8.16 (US$1.36).

Meanwhile, newspaper reports say Cadbury will reject an expected £10.3-billion (US$17-billion) takeover bid from Hershey Co.

Britain's Sunday Times cited an unnamed industry source as saying Cadbury was reluctant to do a deal unless Hershey raised its valuation of the company, which makes the Dairy Milk chocolate bar.

The Wall Street Journal reported on Friday that Hershey was preparing a bid, but that it would not be ready for around two weeks. It said the offer was expected to include at least US$10 billion in cash from Hershey, plus US$2 billion in new Hershey shares and another US$3 billion to US$5 billion in cash from investors in exchange for equity in Hershey.

That bid would top Kraft's US$16.5 billion hostile offer.

New market

Both Kraft and Hershey are seeking access to Cadbury's presence in developing markets, including in Mexico and India. About 250 million bars of the company's famous Dairy Milk are sold every year in 33 countries.

Cadbury on Sunday declined to comment on the speculation.

"We have always said that we would give proper consideration to any serious offer that delivers full value for the company," the company said in a statement. "Unless and until we find ourselves in that situation, we have nothing to comment upon."

- AP